Companhia de Navegacao Norsul

- Ship Owners

- Ship Managers

Companhia de Navegação Norsul, commonly referred to as Norsul, is a prominent maritime shipping company based in Brazil. Established in 1963, Norsul has grown over the decades to become one of the largest and most respected maritime logistics providers in the country. The company specializes in coastal and international shipping services, catering to a diverse range of cargo including bulk commodities, containers, and other goods.

Key Aspects of Norsul

Fleet and Services:

Norsul operates a modern fleet of vessels optimized for various types of cargo. Their fleet includes bulk carriers, container ships, and specialized vessels, enabling them to offer a wide array of shipping solutions. They provide services such as chartering, coastal navigation, port operations, and integrated logistics solutions.Operational Reach:

While Norsul primarily focuses on the Brazilian domestic market, it also extends its services internationally, covering major trade routes and ports in the Americas, Europe, and beyond.Sustainability and Innovation:

Norsul places a significant emphasis on sustainability and environmental responsibility. The company invests in new technologies and practices to reduce its environmental footprint, such as adopting fuel-efficient engines and exploring alternative fuels.Quality and Safety:

The company adheres to stringent safety and quality standards, ensuring the protection of cargo, vessel crews, and the marine environment. They comply with international maritime regulations and continuously work on enhancing their safety protocols.Customer-Centric Approach:

Norsul is known for its customer-centric approach, offering tailored logistics solutions to meet the specific needs of its clients. They maintain strong relationships with their customers, focusing on reliability, timeliness, and cost-efficiency.Market Sectors:

The company serves a variety of industries including agriculture, mining, energy, construction, and manufacturing, thereby playing a crucial role in supporting Brazil's economy.

Challenges and Future Prospects

Norsul, like many other companies in the shipping industry, faces challenges such as fluctuating global trade dynamics, regulatory changes, and environmental pressures. However, its commitment to innovation and sustainability positions it well to navigate these challenges.

Looking forward, Norsul aims to expand its operational capabilities, enhance its fleet with more environmentally friendly vessels, and explore new markets. Continuous investment in technology and strategic partnerships will likely be key components of their growth strategy.

In summary, Companhia de Navegação Norsul is a significant player in the maritime logistics sector in Brazil, with a strong focus on sustainability, customer satisfaction, and operational excellence.

Rio de Janeiro Brazil

Rio de Janeiro RJ 20021-040

Brazil

Ships

BABITONGA BAY

General Cargo (single deck) | Flag: Brazil | Port: SAO FRANCISCO DO SUL

GUANABARA BAY

General Cargo (single deck) | Flag: Brazil | Port: SAO FRANCISCO DO SUL

NORSUL ABROLHOS

Tug | Flag: Brazil | Port: PORTO SEGURO

NORSUL BELMONTE

Tug | Flag: Brazil | Port: PORTO SEGURO

NORSUL CRATEUS

Bulk Carrier | Flag: Brazil | Port: RIO DE JANEIRO

NORSUL RIO

Tug | Flag: Brazil | Port: RIO DE JANEIRO

NORSUL VEGA

Tug | Flag: Brazil | Port: SAO FRANCISCO DO SUL

NORSUL VITORIA

Tug | Flag: Brazil | Port: SAO FRANCISCO DO SUL

PIO GRANDE

Bulk Carrier | Flag: Brazil | Port: RIO DE JANEIRO

NORSUL 14

Barge | Flag: Federative Republic of Brazil | Port: RIO DE JANEIRO

Maritime News

Shipbuilding - JV Company Orders Containership Pair

Trump Administration Drops Gauntlet on UN Fuel Rules, Threatens Tariffs

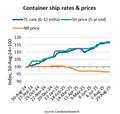

Second-hand Containership Prices Soar in the Face of Soft Shipping Rates

“2 Days, 50 Ports”: New Wave Media Acquires Port of the Future Conference & Exhibition