CHINA NATIONAL OFFSHORE OIL CORPORATION(CNOOC)

The China National Offshore Oil Corporation (CNOOC) is one of the major state-owned oil companies in China, primarily involved in the exploration and production of oil and natural gas. CNOOC is China's largest producer of offshore crude oil and natural gas.

Key Facts About CNOOC:

1. Establishment and Structure:

- Founded: CNOOC was established in 1982.

- Headquarters: Beijing, China.

- Ownership: It is a state-owned enterprise, under the direct administration of the State-Owned Assets Supervision and Administration Commission (SASAC) of the State Council.

2. Operations:

- Exploration and Production: The core business of CNOOC is the exploration and production of offshore crude oil and natural gas. The company operates both in Chinese waters and internationally.

- Refining and Marketing: CNOOC also engages in the refining and marketing of petroleum products.

- Pipeline Operations: Involves the transportation of oil and gas through pipelines.

- Oilfield Services: The provision of technical services to the petroleum industry, including drilling, logging, testing, and engineering.

3. International Presence:

CNOOC has a global footprint, with operations in various countries including the United States, Canada, Brazil, Nigeria, and Argentina. The company has expanded its international presence through a combination of joint ventures, partnerships, and acquisitions.

4. Major Projects:

CNOOC has been involved in significant projects like:

- LNG Projects: Liquefied natural gas projects in Australia and Canada.

- Deep-Water Exploration: Engages in deep-water drilling projects in the South China Sea and other regions.

- Acquisitions: For instance, the acquisition of Canadian oil and gas company Nexen Inc. in 2013, which was a pivotal move to strengthen its international portfolio.

5. Financial Performance:

CNOOC is generally seen as a financially robust entity, frequently reporting substantial revenues and profits due to its stronghold in offshore oil and gas production.

6. Technological and R&D Focus:

CNOOC invests in technology and research and development to enhance its operational efficiency and develop new methods for oil extraction, particularly in challenging offshore environments.

7. Environmental and Social Responsibility:

Like many large corporations, CNOOC is also actively involved in corporate social responsibility (CSR) initiatives. The company emphasizes sustainability and environmental protection in its various operations.

8. Strategic Objectives:

CNOOC's strategic objectives focus on expanding its reserves and production capabilities, optimizing its asset portfolio, enhancing technological capabilities, and bolstering its international competitiveness.

Challenges:

- Regulatory Risks: Operating in multiple international jurisdictions exposes CNOOC to regulatory risks and geopolitical tensions.

- Market Volatility: The company's financial performance is sensitive to fluctuations in global oil prices.

- Environmental Concerns: As with all oil and gas companies, CNOOC faces pressures from environmental groups and regulators to minimize its ecological footprint.

Conclusion:

CNOOC is a cornerstone of China’s strategy to ensure energy security and reduce dependency on foreign energy imports. As a leading entity in the exploration and production of offshore oil and natural gas, it continues to play a critical role in the global energy landscape.

Would you like to know more about any specific aspect of CNOOC?

Beijing China

Beijing Beijing 100007

China

Ships

BO HAI NO.10

Self Elevating Unit | Flag: People's Republic of China | Port: Tianjin

BO HAI NO.4

Self Elevating Unit | Flag: People's Republic of China | Port: Tianjin

Hai Yang Shi You 981

Column Stabilized Unit | Flag: People's Republic of China | Port: ZHANJIANG

BO HAI NO.8

Self Elevating Unit | Flag: People's Republic of China | Port: Tianjin

Maritime News

Shipbuilding - JV Company Orders Containership Pair

Trump Administration Drops Gauntlet on UN Fuel Rules, Threatens Tariffs

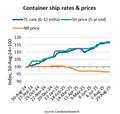

Second-hand Containership Prices Soar in the Face of Soft Shipping Rates

“2 Days, 50 Ports”: New Wave Media Acquires Port of the Future Conference & Exhibition