Bremer Vulkan AG Schiffbau und Masc hinenfabrik

- Shipyards

Bremer Vulkan AG Schiffbau und Maschinenfabrik, commonly known as Bremer Vulkan, was a prominent German shipbuilding company based in Bremen, Germany. The company has a storied history that dates back to its foundation in 1893. Bremer Vulkan played a significant role in shipbuilding, particularly during the 20th century, contributing to both commercial and military naval architecture.

Early History and Growth

- Foundation and Expansion (1893-1945): Founded in 1893, Bremer Vulkan rapidly grew into one of the major shipyards in Germany. It was instrumental in constructing various types of vessels including cargo ships, passenger liners, and naval ships. During both World Wars, Bremer Vulkan was involved in building warships and submarines, which highlighted its strategic importance.

Post-War Era

- Reconstruction and Diversification (1945-1980s): After World War II, the shipyard underwent significant reconstruction. In the ensuing decades, Bremer Vulkan diversified its portfolio, producing tankers, container ships, and specialized vessels like icebreakers. The company also ventured into producing heavy machinery, marking its presence in the broader industrial landscape.

Decline and Insolvency

Challenges and Competition (1990s): The late 20th century brought increased competition from Asian shipbuilders, which significantly impacted European shipbuilding companies. Bremer Vulkan faced financial difficulties during this period, struggling to compete with lower-cost producers in Japan, South Korea, and later China.

Insolvency (1996-1997): The financial pressures culminated in Bremer Vulkan declaring insolvency in 1996. Despite attempts to restructure and secure financial aid, the company could not sustain operations and ultimately ceased shipbuilding activities in 1997. This marked the end of an era for the historic shipyard.

Legacy

Technological Contributions: Bremer Vulkan was known for its engineering prowess and contributions to naval architecture. It was a pioneer in several shipbuilding techniques and was recognized for the quality of its vessels.

Economic Impact: The company played a crucial role in Bremen's economy, providing employment to thousands and contributing to the region's industrial growth. The closure of Bremer Vulkan had a significant impact on the local economy and shipbuilding community.

Bremer Vulkan Today

- Site and Successors: The shipyard site was eventually repurposed, with portions of the facilities being used by smaller shipbuilding firms and other industrial enterprises. Some former subsidiaries and divisions continued to operate independently or were absorbed by other companies.

Bremer Vulkan's history is a reflection of the broader trends in global shipbuilding, characterized by periods of innovation and growth, followed by challenges due to shifting economic conditions and competitive pressures. Despite its closure, the company's legacy continues to be felt in the shipbuilding industry and in the history of Bremen.

Ships

AL SHUWAIKH

Livestock Carrier | Flag: Kuwait | Port: KUWAIT

Maritime News

Shipbuilding - JV Company Orders Containership Pair

Trump Administration Drops Gauntlet on UN Fuel Rules, Threatens Tariffs

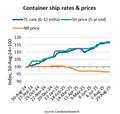

Second-hand Containership Prices Soar in the Face of Soft Shipping Rates

“2 Days, 50 Ports”: New Wave Media Acquires Port of the Future Conference & Exhibition