Bourbon Offshore MMI DMCEST

- Ship Managers

Bourbon Offshore MMI DMCEST is a company that operates within the maritime and offshore industry, offering a range of services primarily to the oil and gas sector. As part of the larger Bourbon group, which is a global leader in marine services, Bourbon Offshore MMI specializes in providing high-quality, reliable services to support offshore exploration, development, and production activities.

Key Aspects of Bourbon Offshore MMI's Operations:

Fleet Services:

- The company operates a diverse fleet of offshore support vessels (OSVs), which include platform supply vessels (PSVs), anchor handling tug supply vessels (AHTSs), and other specialized vessels that support offshore drilling, construction, and production operations.

Operational Expertise:

- Bourbon Offshore MMI leverages extensive experience and technical know-how to deliver services that meet the rigorous demands of the offshore oil and gas industry. This includes navigating challenging environments and adhering to strict safety and operational standards.

Geographical Reach:

- The company provides services in various parts of the world, reflecting the Bourbon group's global presence. This enables them to support multinational oil and gas companies across different offshore regions.

Safety and Compliance:

- Emphasizing safety and regulatory compliance is a core aspect of Bourbon Offshore MMI's operations. The company adheres to international maritime regulations and best practices to ensure the safety of its personnel, vessels, and the environment.

Innovation and Technology:

- Bourbon Offshore MMI leverages advanced technology and innovative solutions to enhance operational efficiency and service quality. This includes the use of cutting-edge navigation systems, real-time monitoring, and sustainable practices to minimize environmental impact.

Local Expertise and Workforce:

- The company often employs a mix of local and international workforce, combining local knowledge with global expertise. This helps in creating job opportunities in the regions they operate and ensures that they meet local regulatory and cultural expectations.

Parent Company: Bourbon Group

- Overview: The Bourbon group is a prominent player in the marine services sector, offering a wide range of maritime and subsea services for various industrial applications.

- Global Operations: With a presence in over 30 countries, Bourbon services a multitude of clients in the offshore oil and gas industry, ensuring the best practices and consistent service delivery across different geographies.

- Commitment to Sustainability: Bourbon group is committed to sustainable operations, continuously working on reducing the environmental footprint of their fleet through innovation and efficiency improvements.

In summary, Bourbon Offshore MMI DMCEST is an integral part of the Bourbon group's extensive service network, providing specialized, high-quality maritime services to the offshore energy sector. The company’s focus on safety, innovation, and global operational capacity enables it to meet the diverse needs of its clients in the offshore industry.

Ships

BOURBON VIKING

Supply Vessel | Flag: St Vincent and The Grenadines | Port: Kingstown

BOURBON LIBERTY 227

Offshore Support Vessel | Flag: Grand Duchy of Luxembourg | Port: LUXEMBOURG

BOURBON LIBERTY 204

Offshore Support Vessel | Flag: Grand Duchy of Luxembourg | Port: LUXEMBOURG

BOURBON LIBERTY 160

Offshore Support Vessel | Flag: Saint Vincent and The Grenadines | Port: Kingstown

BOURBON LIBERTY 248

Offshore Support Vessel | Flag: Grand Duchy of Luxembourg | Port: LUXEMBOURG

BOURBON LIBERTY 253

Offshore Support Vessel | Flag: Grand Duchy of Luxembourg | Port: LUXEMBOURG

BOURBON LIBERTY 222

Offshore Support Vessel | Flag: Grand Duchy of Luxembourg | Port: LUXEMBOURG

BOURBON LIBERTY 122

Offshore Support Vessel | Flag: Grand Duchy of Luxembourg | Port: LUXEMBOURG

BOURBON LIBERTY 151

Offshore Support Vessel | Flag: Grand Duchy of Luxembourg | Port: LUXEMBOURG

BOURBON LIBERTY 161

Offshore Support Vessel | Flag: Saint Vincent and The Grenadines | Port: Kingstown

BOURBON LIBERTY 252

Offshore Support Vessel | Flag: Grand Duchy of Luxembourg | Port: LUXEMBOURG

BOURBON LIBERTY 108

Offshore Support Vessel | Flag: Saint Vincent and The Grenadines | Port: Kingstown

Maritime News

Shipbuilding - JV Company Orders Containership Pair

Trump Administration Drops Gauntlet on UN Fuel Rules, Threatens Tariffs

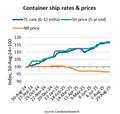

Second-hand Containership Prices Soar in the Face of Soft Shipping Rates

“2 Days, 50 Ports”: New Wave Media Acquires Port of the Future Conference & Exhibition