Bourbon Interoil Nigeria Ltd.

- Ship Owners

- Ship Managers

Bourbon Interoil Nigeria Ltd. is a prominent player in the offshore oil and gas services industry in Nigeria. It is a subsidiary of Bourbon Group, which is a global leader in marine services for offshore oil and gas. The company is involved in providing a range of maritime services to support the exploration, development, and production of offshore oil and gas fields.

Key Areas of Operation:

Marine Logistics Services:

- Platform Supply Vessels (PSVs): These vessels are used to transport equipment, supplies, and personnel to and from offshore oil and gas platforms.

- Anchor Handling Tug Supply Vessels (AHTS): These are specialized vessels that assist in the positioning and mooring of oil rigs and platforms.

Subsea Services:

- Provision of Remotely Operated Vehicles (ROVs) and other subsea equipment for underwater inspections, maintenance, and construction.

Crew Services:

- Transport of offshore workers to and from oil and gas installations.

Combating Pollution:

- Providing services and equipment to manage and mitigate environmental pollution, primarily oil spills.

Safety and Compliance:

Bourbon Interoil Nigeria Ltd. places a strong emphasis on safety and regulatory compliance, adhering to both local and international standards. This includes rigorous training programs, regular maintenance of their fleet, and strict adherence to environmental guidelines.

Local Content:

As part of the Nigerian Local Content initiative, the company focuses on employing and training Nigerian nationals, fostering skills, and contributing to the local economy. They collaborate closely with local suppliers and stakeholders to enhance the socio-economic development of the regions in which they operate.

Technological Innovation:

The company continues to invest in cutting-edge technology and advanced maritime solutions to improve operational efficiency, safety, and environmental sustainability.

Corporate Social Responsibility (CSR):

Bourbon Interoil Nigeria Ltd. also engages in various CSR activities, contributing to the communities where they operate through initiatives in education, healthcare, and environmental conservation.

Challenges:

Like many companies in the oil and gas sector, Bourbon Interoil Nigeria Ltd. faces challenges such as fluctuating oil prices, regulatory changes, and geopolitical risks. However, their diversified services and strong operational foundations help them navigate these challenges.

Global Reach:

While Bourbon Interoil Nigeria Ltd. operates primarily in Nigeria, its parent company, Bourbon Group, has a global presence, allowing for a wealth of shared expertise, resources, and best practices.

In summary, Bourbon Interoil Nigeria Ltd. is a key player in the Nigerian offshore oil and gas sector, known for its comprehensive maritime services, commitment to safety and local content, and contributions to technological and social development.

Ships

BOURBON AXELLE

Supply Vessel | Flag: St Vincent and The Grenadines | Port: Kingstown

BOURBON LEVANT

Supply Vessel | Flag: Nigeria | Port: LAGOS

BOURBON LIBECCIO

Supply Vessel | Flag: Vanuatu | Port: PORT VILA

BOURBON OX

Tug | Flag: Nigeria | Port: LAGOS

SURFER 328

Tender | Flag: Nigeria | Port: LAGOS

TEBAH

Supply Vessel/Tug | Flag: Nigeria | Port: LAGOS

Maritime News

Shipbuilding - JV Company Orders Containership Pair

Trump Administration Drops Gauntlet on UN Fuel Rules, Threatens Tariffs

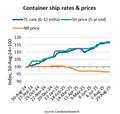

Second-hand Containership Prices Soar in the Face of Soft Shipping Rates

“2 Days, 50 Ports”: New Wave Media Acquires Port of the Future Conference & Exhibition