Bakri Navigation Co. Ltd.

- Ship Owners

Bakri Navigation Co. Ltd. is a recognized maritime transport company that specializes in the shipping and logistics sector. Here are several key aspects typically associated with the company:

History and Background: Bakri Navigation Co. Ltd., established in Saudi Arabia, is a subsidiary of Bakri International Energy Company. The parent company has diverse interests in energy sectors, including oil and gas, and Bakri Navigation complements these activities by focusing on the transportation of oil and refined petroleum products.

Core Activities: The company primarily engages in the shipping and maritime transport of crude oil, petroleum products, chemicals, and other bulk cargo. This involves operating a fleet of tankers and other vessels designed to safely and efficiently transport these commodities worldwide.

Fleet and Operations: Bakri Navigation manages a modern and technologically advanced fleet of vessels, which often include Very Large Crude Carriers (VLCCs), Aframax, and Suezmax tankers. The fleet’s operations are supported by sophisticated logistics and monitoring systems to ensure safety, compliance with international maritime regulations, and timely delivery.

Global Reach: While based in Saudi Arabia, Bakri Navigation’s operations have a global footprint. This involves traversing key international shipping routes and docking at major ports around the world. Such extensive reach allows the company to serve a wide range of clients in various geographical regions.

Safety and Environmental Standards: Given the nature of its cargo, Bakri Navigation places a strong emphasis on safety and environmental stewardship. The company adheres to stringent international standards and best practices to minimize environmental impact and ensure the safety of its crew and cargo.

Market Position: Bakri Navigation holds a significant position in the maritime transport industry, particularly in the Middle East. It serves a variety of international and regional clients, including major oil companies, refineries, and trading firms.

Partnerships and Alliances: To enhance its capabilities and market reach, Bakri Navigation often forms strategic partnerships and alliances with other companies in the maritime and energy sectors. These collaborations can involve joint ventures, sharing of resources, and cooperative logistics operations.

If you are interested in doing business with Bakri Navigation or want more specific information about their current operations, vessels, or services, it would be best to visit their official website or contact their corporate office directly.

Ships

AL BARRAH

Liquefied Gas Carrier (LPG) | Flag: Saudi Arabia | Port: DAMMAM

AL JABIRAH

Liquefied Gas Carrier (LPG) | Flag: Saudi Arabia | Port: DAMMAM

AL MUKHTARAH

Tanker for Oil | Flag: Saudi Arabia | Port: DAMMAM

BORAQ

Tanker for Chemicals & Oil Products | Flag: Saudi Arabia | Port: DAMMAM

QURTUBA

Tanker for Chemicals & Oil Products | Flag: Saudi Arabia | Port: DAMMAM

Maritime News

Shipbuilding - JV Company Orders Containership Pair

Trump Administration Drops Gauntlet on UN Fuel Rules, Threatens Tariffs

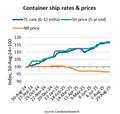

Second-hand Containership Prices Soar in the Face of Soft Shipping Rates

“2 Days, 50 Ports”: New Wave Media Acquires Port of the Future Conference & Exhibition