Baker Hughes Incorporated

Baker Hughes Incorporated, commonly known simply as Baker Hughes, is a prominent player in the oilfield services industry. The company provides a wide range of products and services to the global oil and gas sectors, encompassing exploration, drilling, formation evaluation, completion, production, and reservoir management. Below are some key aspects of the company:

History and Formation

- Early Days: Baker Hughes was founded in 1987 through the merger of Baker International and Hughes Tool Company, both of which had long histories in the oil and gas industry. Hughes Tool Company, established by Howard Hughes Sr., was known for inventing the dual-cone drill bit.

- Evolution: The company has since grown through various mergers, acquisitions, and developments to become one of the leading service providers in the industry.

Products and Services

- Drilling Services: Baker Hughes offers advanced drilling technologies and services, including rotary steerable systems, drill bits, and drilling fluids.

- Evaluation and Monitoring: The company provides a range of evaluation services such as well logging, formation evaluation, and reservoir characterization.

- Completion and Production: They offer solutions for well completion and production enhancements, including wellbore intervention, intelligent production systems, and artificial lift technologies.

- Digital Solutions: In recent years, Baker Hughes has expanded into digital technology and data analytics to improve operational efficiencies and decision-making processes in the oil and gas sector.

Global Presence

- International Operations: Baker Hughes operates in more than 120 countries around the world, with a significant presence in key oil-producing regions such as the Middle East, North America, Africa, and Asia-Pacific.

- Employee Base: The company employs tens of thousands of people globally, making it one of the largest employers in the oilfield services sector.

Strategic Initiatives

- Sustainability: Baker Hughes has been focusing on sustainable energy solutions and reducing the environmental impact of oil and gas operations. This includes investments in cleaner technology and partnerships aimed at carbon reduction.

- Innovation: The company continually invests in R&D to develop cutting-edge technologies and solutions that enhance efficiency, safety, and cost-effectiveness for its clients.

Significant Milestones

- GE Oil & Gas Merger: In 2017, Baker Hughes merged with GE Oil & Gas to form Baker Hughes, a GE Company (BHGE), making it one of the world's largest oilfield services companies. However, GE subsequently began reducing its stake in the company, and by 2020 Baker Hughes became an independent entity once again.

Financial Performance

- Revenue: Baker Hughes' revenue and financial performance depend heavily on the oil and gas market's fluctuations, with revenue streams derived from both product sales and service contracts.

- Stock Market: The company's stock (BKR) is publicly traded on the New York Stock Exchange (NYSE).

Challenges and Opportunities

- Market Volatility: Being in the oil and gas sector, Baker Hughes faces market volatility, regulatory changes, and geopolitical risks.

- Energy Transition: The global shift towards renewable energy presents both a challenge and an opportunity for the company to diversify and innovate in new energy technologies.

In summary, Baker Hughes Incorporated is a key player in the oilfield services industry with a rich history, extensive global operations, and a focus on innovation and sustainability. The company is continually adapting to the changing landscape of the energy sector, driven by technological advancements and the global push for greener energy solutions.

- +020 12222 98 68

- interchange/default/default.asp

- +0202 25193045

Products

Oil tools

Cairo Egypt

21, Road 263 New Maadi

Cairo 416 482

Egypt

Cairo 416 482

Egypt

Maritime News

Trump Administration Drops Gauntlet on UN Fuel Rules, Threatens Tariffs

The United States has told countries to reject a United Nations' marine fuel emissions-cutting deal or face tariffs, visa restrictions and port levies, U.S. and European officials and sources told Reuters.The Trump administration is looking to boost U.S. economic might, including by taking a bigger role in global shipping, and has used tariffs as a weapon to extract better terms from Washington’s trade partners.In April, countries struck a draft agreement through the U.N.'s International Maritime Organization (IMO) that would impose a fee on ships that breach global carbon emissions standards.

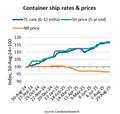

Second-hand Containership Prices Soar in the Face of Soft Shipping Rates

Despite significantly weaker freight rates, the average price for five-year-old container ships has increased 17% year-on-year and 6% since the beginning of 2025,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.The average per TEU price of a basket of seven five-year-old container ships was $9,761/TEU in late August 2024. Since then, the price has risen to $10,758/TEU at the beginning of 2025 and to $11,413/TEU in late August.Feeder ships smaller than 3,000 TEU have seen the highest price increase at an average of 26% year-on-year.

“2 Days, 50 Ports”: New Wave Media Acquires Port of the Future Conference & Exhibition

New Wave Media, a leading B2B media company serving the global maritime, offshore energy, subsea and logistics sectors, acquired the Port of the Future Conference & Exhibition, a premier international symposium known for its focus on advancing port infrastructure, technology, and policy.Under the continued leadership of its founder, Kevin Clement, the event will retain its iconic tagline — “2 Days, 50 Ports” — and continue to convene top-tier port and terminal executives from around the world.The 2026 Port of the Future Conference is scheduled to be held March 23-25, 2026, at the Hilton University of Houston.

HD Hyundai Philippines Cuts Steel on First Vessel

HD Korea Shipbuilding & Offshore Engineering (HD KSOE) has conducted a steel cutting ceremony for a 115,000-ton product tanker at the HD Hyundai Philippines Shipyard in Subic Bay, Philippines.The vessel is the first ship built by HD Hyundai Philippines and is the first in a series of four vessels ordered from an Asian shipping company in December last year.Last May, HD KSOE signed a lease agreement with Cerberus Capital for a portion of the Philippine shipyard site, marking the launch of this second HD KSOE overseas shipyard.

U.S. Coast Guard Spends its First One Big Beautiful Bill Act Funds

The U.S. Coast Guard’s Facilities Design and Construction Center completed a contract modification with The Whiting-Turner Contracting Company Aug. 25 to remove up to 100 submerged concrete piles under the old Pier November at Base Charleston in North Charleston, South Carolina. The modification, with a potential value of approximately $14.8 million, includes work that is necessary to complete construction of new, modernized piers to provide support and logistics for up to five major cutters homeported at the base.