Arctic Umiaq Line A/S

- Ship Owners

- Ship Managers

Arctic Umiaq Line A/S is a Greenlandic maritime company that provides passenger and cargo transportation services along the western coast of Greenland. The company operates a year-round coastal ferry service that connects numerous settlements and towns from Qaqortoq in the south to Ilulissat in the north, including the capital city, Nuuk.

Here's an overview of some key aspects of the company:

History

- Formation: Arctic Umiaq Line was established to ensure reliable and essential maritime transportation services in Greenland, which is characterized by its sparse population and lack of road infrastructure connecting most communities.

- Public Ownership: It is commonly owned by the Greenlandic government, reflecting its critical role in local infrastructure and connectivity.

Services

- Passenger Transportation: The ferry service is vital for moving people between settlements, especially for purposes like medical appointments, education, and family visits. It also serves as a lifeline during the summer tourist season, offering unique travel experiences in the Arctic.

- Cargo Transport: Arctic Umiaq Line also handles freight transport, delivering goods to various communities that would be otherwise difficult to reach due to Greenland's challenging geography.

Fleet

- Main Vessel: The company typically operates a few vessels designed to navigate the icy waters of Greenland. The "Sarfaq Ittuk" is a notable vessel used for the majority of its passenger and cargo services.

- Seasonal Adjustments: Depending on weather conditions and the demand, the fleet operations might adjust seasonally, especially considering ice coverage and daylight availability.

Logistics and Connectivity

- Schedules: The ferry schedules are carefully planned to optimize connections between settlements, often synchronizing with flights and other local transportation modes.

- Accessibility: Routes and operations are frequently adapted to ensure accessibility and safety, which are paramount given the remote and often harsh Arctic conditions.

Challenges and Importance

- Weather and Ice Navigation: Given the Arctic environment, the company faces significant challenges, including navigating through waters that can be covered with ice for large portions of the year.

- Economic Role: Arctic Umiaq Line supports not just the mobility of people but also the local economy by enabling trade and the flow of goods. It is crucial for both everyday needs of residents and the broader economic activities, including tourism.

Contribution to Sustainability

- Environmental Impact: Operating in a sensitive ecological zone, the company is likely involved in initiatives to minimize its environmental footprint. This could include efforts related to fuel efficiency, waste management, and sustainable operations.

Arctic Umiaq Line A/S plays a critical role in Greenland's infrastructure by providing essential transportation services that support both the livelihood of its residents and the local economy.

Ships

SARFAQ ITTUK

Passenger Ship | Flag: Greenland | Port: NUUK

Maritime News

Shipbuilding - JV Company Orders Containership Pair

ElbFeeder, a joint venture of the Icelandic transportation company Eimskip and German listed ship-owner Ernst Russ, signed contracts for a pair of 2,280-TEU container vessels with the shipyard China Merchants Jin Ling Shipyard (Nanjing) Co. Ltd. The newbuildings will be an addition to the ElbFeeder joint venture and expand it to a total of nine vessels. Options for two additional vessels were negotiated.The newbuildings will be employed in the Eimskip Blue Line between Reykjavik and Rotterdam for an initial 10-year period through a time-charter agreement signed in combination with the newbuilding contract.

Trump Administration Drops Gauntlet on UN Fuel Rules, Threatens Tariffs

The United States has told countries to reject a United Nations' marine fuel emissions-cutting deal or face tariffs, visa restrictions and port levies, U.S. and European officials and sources told Reuters.The Trump administration is looking to boost U.S. economic might, including by taking a bigger role in global shipping, and has used tariffs as a weapon to extract better terms from Washington’s trade partners.In April, countries struck a draft agreement through the U.N.'s International Maritime Organization (IMO) that would impose a fee on ships that breach global carbon emissions standards.

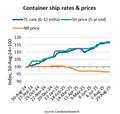

Second-hand Containership Prices Soar in the Face of Soft Shipping Rates

Despite significantly weaker freight rates, the average price for five-year-old container ships has increased 17% year-on-year and 6% since the beginning of 2025,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.The average per TEU price of a basket of seven five-year-old container ships was $9,761/TEU in late August 2024. Since then, the price has risen to $10,758/TEU at the beginning of 2025 and to $11,413/TEU in late August.Feeder ships smaller than 3,000 TEU have seen the highest price increase at an average of 26% year-on-year.

“2 Days, 50 Ports”: New Wave Media Acquires Port of the Future Conference & Exhibition

New Wave Media, a leading B2B media company serving the global maritime, offshore energy, subsea and logistics sectors, acquired the Port of the Future Conference & Exhibition, a premier international symposium known for its focus on advancing port infrastructure, technology, and policy.Under the continued leadership of its founder, Kevin Clement, the event will retain its iconic tagline — “2 Days, 50 Ports” — and continue to convene top-tier port and terminal executives from around the world.The 2026 Port of the Future Conference is scheduled to be held March 23-25, 2026, at the Hilton University of Houston.

HD Hyundai Philippines Cuts Steel on First Vessel

HD Korea Shipbuilding & Offshore Engineering (HD KSOE) has conducted a steel cutting ceremony for a 115,000-ton product tanker at the HD Hyundai Philippines Shipyard in Subic Bay, Philippines.The vessel is the first ship built by HD Hyundai Philippines and is the first in a series of four vessels ordered from an Asian shipping company in December last year.Last May, HD KSOE signed a lease agreement with Cerberus Capital for a portion of the Philippine shipyard site, marking the launch of this second HD KSOE overseas shipyard.