A.P. Moller-Maersk A/S

- Ship Managers

- Ship Owners

A.P. Moller-Maersk A/S, commonly known as Maersk, is a Danish multinational conglomerate with a primary focus on the global supply chain, particularly in the shipping and logistics sector. Founded in 1904 by Peter Mærsk Møller and Arnold Peter Møller, Maersk has grown to become one of the world's largest and most influential players in the maritime industry. Here's a detailed overview of the company:

Key Business Areas

Ocean Shipping:

- Maersk Line: The largest division within the company, Maersk Line is one of the world's leading container shipping lines, operating a fleet of hundreds of vessels that carry goods across global trade routes.

Logistics and Services:

- Maersk Logistics & Services: This division offers end-to-end supply chain management, including warehousing, distribution, and freight forwarding services, helping businesses optimize their logistics operations.

Terminals and Towage:

- APM Terminals: Operates a global network of ports and inland services, handling a significant portion of the world's container traffic.

- Svitzer: Provides towage and related maritime services, enhancing the efficiency and safety of marine operations.

Energy Sector:

- Historically, Maersk was involved in oil and gas exploration and production through Maersk Oil. However, the energy division was divested, with Maersk Oil being sold to Total S.A. in 2017.

Financials and Market Presence

- Headquarters: Copenhagen, Denmark.

- Global Reach: Maersk operates in over 130 countries, with a significant presence in virtually all major ports and shipping routes worldwide.

- Revenue and Workforce: As of recent data, Maersk generates multi-billion-dollar annual revenues and employs tens of thousands of people globally.

Recent Developments and Strategic Initiatives

- Digital Transformation: Maersk has been investing heavily in digital technologies to enhance efficiency and customer service. Initiatives include the use of blockchain for improving transparency and efficiency and various digital solutions to streamline the supply chain.

- Sustainability: With growing global attention on environmental sustainability, Maersk aims to achieve carbon neutrality by 2050. This includes investments in greener technologies and alternative fuels for their shipping fleet.

- Integrated Logistics: Maersk is focused on becoming an integrated logistics company, delivering comprehensive, end-to-end solutions that go beyond traditional ocean shipping.

Challenges

- Market Volatility: The shipping industry is highly susceptible to economic fluctuations, supply chain disruptions, and geopolitical tensions, all of which can impact Maersk's operations and financial performance.

- Competition: Maersk faces stiff competition from other major shipping lines and logistics providers, including MSC, CMA CGM, and Hapag-Lloyd.

Conclusion

A.P. Moller-Maersk A/S is a cornerstone of global trade, known for its extensive shipping and logistics capabilities. The company's continued focus on innovation, sustainability, and integrated service offerings positions it well to navigate the complexities of the modern supply chain landscape.

Ships

MÆRSK CHAMPION

Supply Vessel/Tug | Flag: Denmark | Port: RINGKØBING

MÆRSK INNOVATOR

Self-elevating Unit | Flag: Denmark | Port: SVENDBORG

MÆRSK INSPIRER

Self-elevating Unit | Flag: Denmark | Port: ESBJERG

NEDLLOYD DE LIEFDE

Container Ship | Flag: Netherlands | Port: ROTTERDAM

Maritime News

Shipbuilding - JV Company Orders Containership Pair

Trump Administration Drops Gauntlet on UN Fuel Rules, Threatens Tariffs

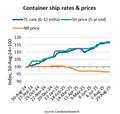

Second-hand Containership Prices Soar in the Face of Soft Shipping Rates

“2 Days, 50 Ports”: New Wave Media Acquires Port of the Future Conference & Exhibition